August 20, 2025

The C-Store Labor Maturity Model explains the operational effectiveness for operators in how well they manage the labor in their stores. Many convenience store operators are facing a growing performance gap relative to their labor-cost line item. Top c-store operators are shifting from simply managing c-store labor costs to optimizing profit drivers instead. That is, they manage and control their labor to optimize service and provide the best customer experience and sales capacity.

Finance-only-driven labor budgets, gut-based scheduling, turnover, and inconsistent execution can all lead to gross profit erosion. Store complexity keeps increasing – food service, loyalty, AI tools, delivery – while the systems used to measure and assess performance struggle to keep up.

The C-Store Labor Costs Challenge

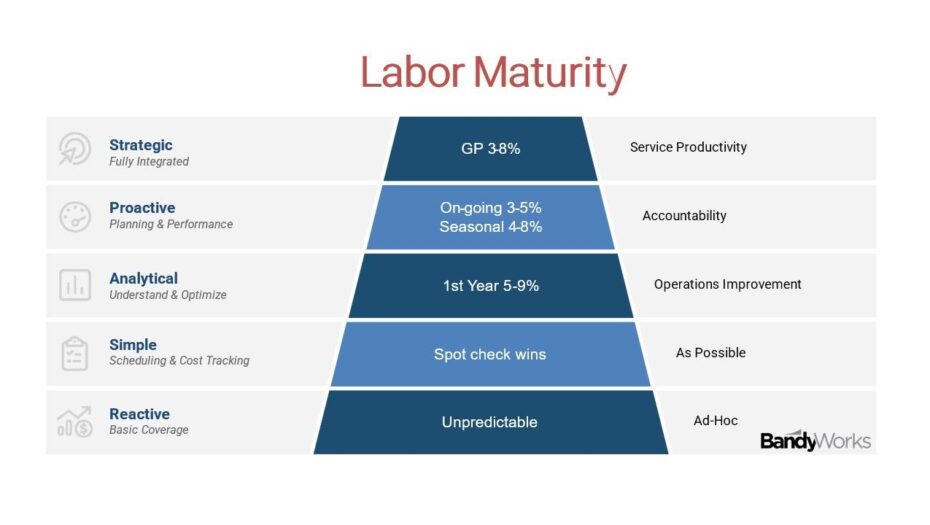

Labor is often the least optimized, and most impactful lever in the operational toolkit. When managed intentionally across the entire organization, labor optimization is a competitive advantage and profit driver. The BandyWorks C-Store Labor Maturity Model outlines five stages of operational labor maturity tied directly to store profitability.

Each stage reflects increased workforce capability across three pillars:

- Team Development (training, accountability, leadership, execution)

- Data & Technology (tools, metrics, integration)

- Audits (policy enforcement, variance tracking, follow-up)

As maturity increases, so does the labor ROI. The five maturity steps are outlined below,

The C-Store Labor Maturity Model: A Strategic Framework

Here, we’ll summarize each stage of maturity through the 3 pillars: Management, Technology/Data and Audits.

Stage 1: Reactive: “Just Keep the Doors Open”

In this survival mode, staffing is ad-hoc. Schedules are based on gut instinct, not sales data. Training is inconsistent or missing. Labor is treated as a necessary cost—not a controllable variable. Someone needs to keep the doors open.

- Team Development: Basic presence. No formal KPIs or accountability.

- Data & Technology: Minimal tools. Tracking limited to hours worked.

- Audit: Informal processes. No documentation or variance reviews.

Profitability Impact: Unpredictable

You might hit payroll targets, but service levels fluctuate, and turnover is rampant. Often, managers are firefighting instead of leading. Keeping the store running is essential and small organizations may be okay with low control and high touch management.

Stage 2: Simple: “We Track Hours. That’s a Start.”

This stage introduces foundational structure. There’s a focus on meeting immediate staffing needs with consistent coverage, and some basic data gets collected.

- Team Development: Basic training in scheduling and coverage.

- Data & Technology: Core metrics tracked—Inside Sales, Hours Worked, Labor Cost % of Sales.

- Audit: Simple schedule vs. actual checks. HR policies are documented.

Profitability Impact: Spot-Check Wins

Scheduling becomes more consistent, and adherence improves. However, optimization is limited. Think of this stage as compliance, not yet control. Significant savings can often be found by experienced leaders, such as thousands of dollars a month, but sustaining the savings requires a lot of manual work and time-consuming follow-up. It’s often difficult for less seasoned staff to achieve the same wins.

Stage 3: Analytical: “We Understand What’s Working—And Why”

The first leap toward performance-based labor management. Data becomes actionable. Managers receive training in key KPIs and begin using reports to inform decisions.

- Team Development: KPI training, variance understanding, goal setting begins.

- Data & Technology: POS and Payroll data integrated; demand patterns analyzed by day/hour.

- Audit: Recruiting/hiring process standardized. Retention matches industry benchmarks.

Profitability Impact: +5–9% in Year One

This is the inflection point. Understanding true labor cost per transaction and aligning schedules with traffic patterns produces fast, measurable gains. A mid-size store may find 30-60 hours of labor opportunity per month. These savings or reallocations can be managed with a regular audit and adjustments 2-4 times a year for seasonality. Sustainability tends to require a more mature oversight and analytical basis as well as investment in manager development for time management and analytics-based decision-making.

Stage 4: Proactive: “We Plan Ahead—and Perform to Target”

Here, labor is actively managed to match business cycles. Managers forecast and flex schedules based on recent scheduling patterns. Retention and training are aligned to performance.

- Team Development: Career paths documented; onboarding personalized; retention above industry average.

- Data & Technology: Multi-source integration (POS, Payroll, Time & Attendance, COGS). Forecasting is fine-tuned and improved.

- Audit: Advanced scheduling, performance coaching, variance management.

Profitability Impact: Sustained +3–5%, Seasonal +4–8%

Labor becomes a controllable lever. For example, managing overstaffing and understaffing, by service levels (e.g., food preparation, seasonality, carwash, training) apply the necessary and sufficient resources to both contain costs and maximize profitable sales. Cost adjustments and profit for mid-size stores with food service offerings can find an additional $500 to $1,500 in monthly savings (profit from cost reduction) or re-allocation per store through seasonal adjustments and fine tuning above Stage 3. Naturally, the complexity of the food service and intensity of the weather variations dramatically impact the level of results.

Stage 5: Strategic: “Labor Drives Brand, Loyalty, and Margin”

The final stage transforms workforce execution into a strategic engine. That is, labor processes systematically drive business objectives, and analytics optimize both people and profit.

- Team Development: Teams are aligned and agile. Leadership development is core.

- Data & Technology: Predictive analytics and schedule optimization drive efficiency.

- Audit: High staff retention. Labor outcomes tie directly to customer loyalty and revenue performance.

Profitability Impact: +3–8%, Plus Loyalty & Stability Gains

At this level, labor is not just optimized, it’s differentiated. Customer experience improves. Retention soars. Leadership is organically developed. Strategic initiatives stick. You don’t just manage labor—you win with it. The cost savings and profit growth stacks on previous stages and now impacts the long-term value of the store by directly driving the customer experience, brand, culture, and sales. The ability to utilize a great team with the correct staffing level supports and encourages the teamwork and workload necessary to sustain long-term results.

Why C-Store Labor Costs Matters Now

Stores that remain reactive lose margin to inefficiency, turnover, and missed opportunities. Those that mature their labor model can outperform larger competitors, reduce churn and grow profitability.

Final Thought: Labor Is Your Hidden Growth Lever

Most retailers manage labor as a constraint. In truth, it’s a hidden engine of growth and margin when managed intentionally. By maturing how you manage, integrate, and audit labor, you’re not just filling shifts; you’re building profit.

Start where you are. Measure what matters. Manage what drives performance.

Related Information for C-Store Labor Maturity Model

You may want to take an assessment of your C-Store operations It provides a written summary along with ideas for new things to consider: C-Store Performance Assessment.